Carbon Dioxide and other Greenhouse Gases are global pollutants. From the atmosphere’s point of view, it doesn’t matter if they originate on the Isle of Man or in China. As far as global warming is concerned, wherever they originate, each one is as destructive as the other.

The nations of the world agree that gas emissions must be reduced, and even if possible eliminated.

Individuals and companies around the world are recognizing the importance of reducing their Greenhouse Gas (GHG) emissions. As a result, many of them are now reducing their carbon footprints through energy efficiency and other measures. Quite often, however, it is not possible for these entities to meet their targets or eliminate their carbon footprint entirely, at least in the near term, with internal reductions alone, and they need a flexible mechanism to achieve these aspirational goals. Enter the carbon markets.

By using the carbon markets, entities can neutralize, or offset, their emissions by retiring carbon credits generated by projects that are reducing GHG emissions elsewhere. Of course, it is critical to ensure, or verify, that the emission reductions generated by these projects are actually occurring.

Once projects have been certified, project owners are be issued with tradable ‘Carbon Credits’. Those Credits can then be sold on the open market and what is called ‘retired’ by individuals and companies as a means to offset their own emissions.

Mandatory and Voluntary use of Carbon Credits: The Role of Carbon Pricing

For some time now, there has been what is called a ‘Cap and Trade’ mechanism in place in some countries and economic blocs such as the European Union. Companies that operate in industries that are heavy polluters of greenhouse gases are obliged by law to measure their emissions and then obtain ‘right to pollute’ permits each year.

By restricting the number of permits that are issued to fewer than would normally be required, the issuing government thereby ‘Caps’ the total number of certificates. Companies that are unable to reduce their emissions below their own allocated number of permits then have to purchase an equivalent number of certficates on an open trading system (the Trade).

In a cap and trade scheme central government does not set the price of carbon, and instead the open market sets the price according to demand. Since the number of available certificates is kept deliberately below the probable demand, the carbon price is kept high enough to encourage companies to seek ways to reduce their own demand by seeking and implementing new technology. When they do not do so, and are obliged to purchase carbon credits, the money raised – which is essentially a carbon tax – can then be used by government to support other decarbonisation initiatives such as supporting low income groups who might otherwise not be able to implement their own schemes.

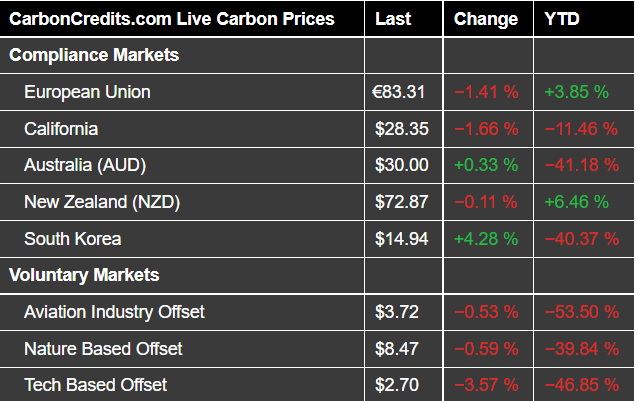

As a consequence, in the European Union where such a cap and trade scheme is in place, the price of carbon has reached over 80 Euros / tCO2eq.